So you’re ready to dive into the exciting world of investing, but the overwhelming ocean of books leaves you feeling like a lost minnow? Fear not, fellow financial voyager! This comprehensive guide cuts through the noise and maps out a treasure trove of the best investing books for all experience levels.

Navigating the Investment Seas

Whether you’re a wide-eyed rookie or a seasoned captain, choosing the right investment books is crucial. We’ve categorized our recommendations to help you chart your course:

1. The Investing Fundamentals

Investing might seem like a daunting and complex realm reserved for financial wizards, but the reality is much simpler. At its core, investing is about putting your money to work for you, allowing it to grow over time and generate additional income. To achieve this, however, it’s crucial to lay a solid foundation built on the investing fundamentals. These fundamental principles serve as the compass guiding your investment journey, regardless of your experience level or risk tolerance:

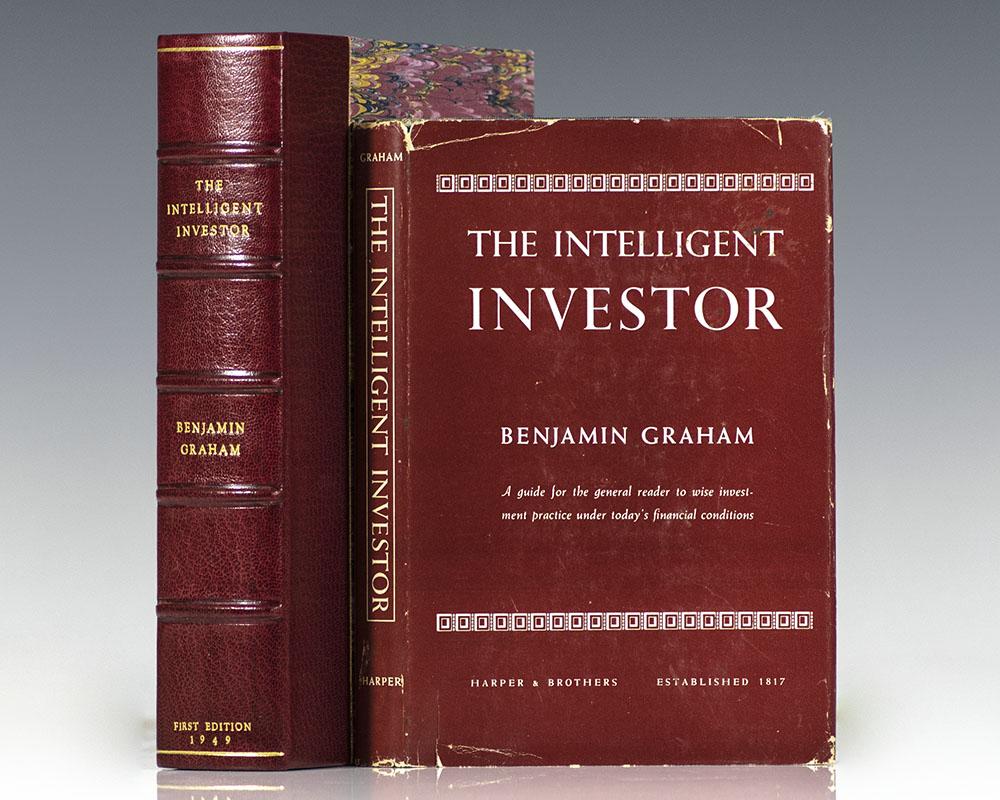

The Intelligent Investor by Benjamin Graham

Benjamin Graham’s “The Intelligent Investor” is an iconic book, revered by some as the investment bible and dismissed by others as outdated relics from a bygone era. But where does the truth lie? Is it still relevant in today’s market? Let’s dive into the pros and cons of this investing classic:

“The Intelligent Investor” is not a “one-size-fits-all” solution. It’s a valuable resource for investors seeking a foundational understanding of value investing and risk management. However, it’s important to approach it with an open mind, considering its limitations and adapting its principles to the current market context. It’s best used as a stepping stone, not a definitive guide, for building a successful investment strategy.

Ultimately, whether “The Intelligent Investor” is outdated or a timeless classic depends on your perspective and investment goals. Regardless, its impact on the investment world and its role in shaping iconic investors like Warren Buffett is undeniable.

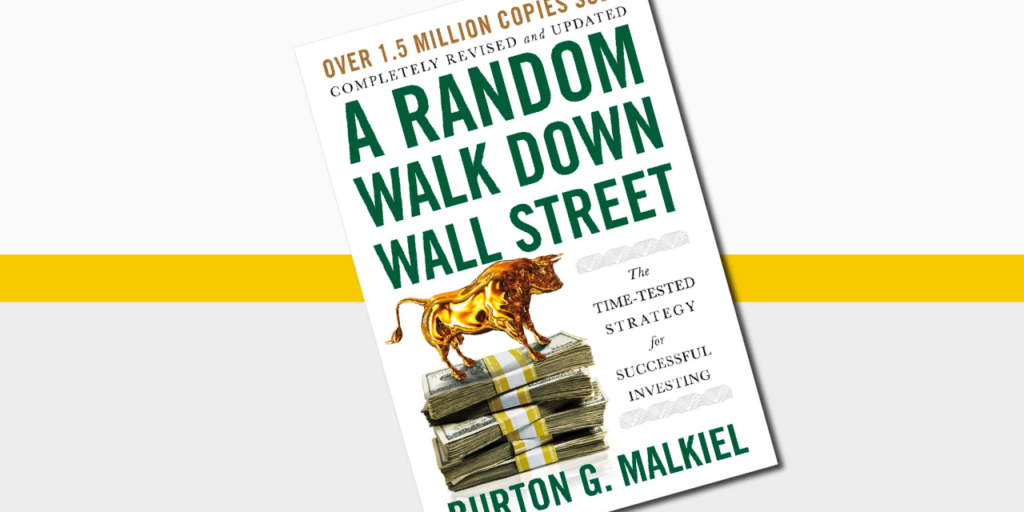

A Random Walk Down Wall Street by Burton Malkiel

Malkiel’s central argument revolves around the random walk hypothesis, which states that stock prices are essentially random and unpredictable in the short term. He argues that attempting to beat the market through stock picking or market timing is often futile, as future price movements are largely determined by unforeseen events and irrational behaviors.

Overall, “A Random Walk Down Wall Street” remains a valuable read for both beginner and experienced investors. It encourages a healthy dose of skepticism towards market predictions and highlights the benefits of a long-term, passive investment approach using index funds. However, it’s important to remember that the book presents one perspective on the market, and investors should consider their own circumstances and risk tolerance when making investment decisions.

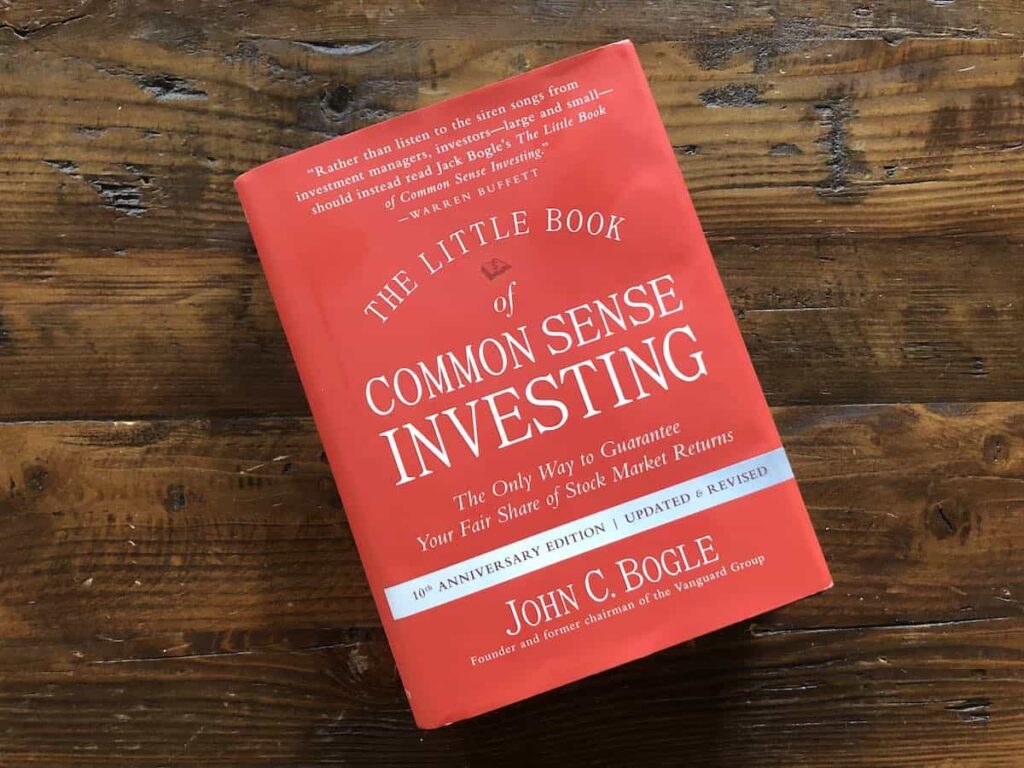

The Little Book of Common Sense Investing by John Bogle

This straightforward guide advocates for low-cost indexing and keeping emotions out of investing decisions. John Bogle’s “The Little Book of Common Sense Investing” is a refreshingly straightforward guide that cuts through the noise of Wall Street and presents a simple, yet powerful, investing strategy.

Overall, “The Little Book of Common Sense Investing” is a timeless classic that empowers individuals to take control of their financial future. It provides a clear roadmap for building wealth through a simple, low-cost, and accessible approach. Although limitations exist, its emphasis on long-term, passive investing aligns with sound financial principles, making it a valuable resource for investors of all experience levels.

2. Mastering the Market Mindset:

The stock market: a thrilling rollercoaster of potential gains and gut-wrenching losses. While understanding charts and analyzing fundamentals is crucial, a hidden factor often dictates success – your market mindset. It’s your internal compass, navigating through fear, greed, and overconfidence to make rational investment decisions. Mastering this mindset is just as important as mastering investment strategies.

The Psychology of Money by Morgan Housel

Dive into the often-neglected mental aspects of investing with Housel’s engaging and relatable insights. In the realm of investing, understanding the psychological aspects is as crucial as mastering the numbers. Morgan Housel’s “The Psychology of Money” unravels the intricate relationship between individuals and their finances. Housel, a renowned financial journalist, takes readers on a captivating journey through the behavioral nuances that often dictate financial decisions.

“The Psychology of Money” goes beyond traditional financial advice, offering a holistic approach to wealth management. It’s a must-read for anyone seeking to unravel the mysteries of their financial mindset and develop a healthier relationship with money.

Thinking, Fast and Slow by Daniel Kahneman

In the world of investing, understanding the intricacies of decision-making is paramount. Nobel laureate Daniel Kahneman’s “Thinking, Fast and Slow” provides a groundbreaking exploration of the two systems that govern human thinking and how they influence financial choices.

“Thinking, Fast and Slow” is a transformative read for investors seeking to comprehend the psychological underpinnings of decision-making. By embracing the insights offered, individuals can enhance their ability to make rational, informed, and strategic financial choices.

The Confidence Trap by Russ Roberts

Uncover the dangers of overconfidence in the market and embrace humility for better investing outcomes. The Confidence Trap: A History of How Overconfidence Leads Us to War, Wretched Decisions, and Bad Investments” by Russ Roberts offers a unique perspective on the pitfalls of overconfidence in various spheres, including the investment world. Here’s a breakdown of its relevance:.

Overall, “The Confidence Trap” provides a valuable cautionary tale for investors, urging them to approach the market with humility and awareness of their own cognitive biases. It encourages a measured and well-informed approach to investment decisions, which can be crucial for achieving long-term financial success.

3. Venturing Beyond the Basics:

Now that we’ve explored foundational texts and delved into the psychological intricacies of decision-making, it’s time to take your investment knowledge to the next level. Venturing beyond the basics involves embracing advanced concepts and refining your strategies for sustained financial success.

One Up on Wall Street by Peter Lynch

Learn the stock-picking wisdom of a Wall Street legend and discover undervalued gems. In the realm of stock market mastery, Peter Lynch’s “One Up on Wall Street” stands as a beacon, guiding both novice and seasoned investors through the art of picking winning stocks. Lynch, famed for his success as the manager of the Magellan Fund, shares invaluable insights and a unique approach to investing that has stood the test of time.

“One Up on Wall Street” is not just a book; it’s a roadmap to successful stock market investing. Lynch’s approach demystifies the complexities, making investing accessible to everyone. By embracing his principles, investors can gain confidence and navigate the markets with a seasoned perspective.

The Outsiders by William Thorndike Jr.

Get inspired by unconventional CEOs who defied conventional wisdom and built remarkable businesses. William Thorndike Jr.’s “The Outsiders” is a fascinating exploration of unconventional leaders who steered their companies to remarkable success by defying conventional wisdom. Filled with inspiring stories and insightful takeaways, this book offers valuable lessons for aspiring investors and entrepreneurial minds alike.

Instead of focusing on Wall Street giants or flashy stock market trends, Thorndike analyzes a group of CEOs he terms “Outsiders” – individuals who led companies outside the limelight, often employing unorthodox methodologies. These leaders shared certain core traits:

Fooled by Randomness by Nassim Nicholas Taleb

Prepare for unpredictable events and build robustness into your investment strategy. Nassim Nicholas Taleb’s “Fooled by Randomness” throws a provocative wrench into the gears of our neatly ordered understanding of the world. Instead of reassuring narratives of predictable markets and controllable outcomes, Taleb plunges us into the realm of black swans, rare and unpredictable events that upend our expectations and reshape reality. While somewhat counterintuitive, his insights offer valuable lessons for investors seeking to navigate the uncertainties of the market.

4. Diversifying Your Horizons:

In the ever-evolving landscape of investments, diversification remains a cornerstone of building a resilient portfolio. While stocks and bonds are traditional stalwarts, venturing into alternative investments opens up new horizons for astute investors looking to mitigate risk and explore diverse wealth-building opportunities.

I Will Teach You to be Rich by Ramit Sethi

Embark on a transformative journey towards financial success with Ramit Sethi’s “I Will Teach You to be Rich.” This comprehensive guide transcends traditional financial advice, offering practical strategies to not only manage money but to thrive and build wealth strategically.

Broke Millennial Takes On Investing by Erin Lowry

Tailored for millennials, this book offers relatable advice and actionable steps for building wealth. Erin Lowry’s “Broke Millennial Takes On Investing” serves as a beacon for the younger generation, demystifying the complexities of investing and providing a roadmap for financial empowerment. Tailored to millennials, this book offers practical insights and actionable steps to navigate the world of investing with confidence.

The Simple Path to Wealth by J.L. Collins

Discover the power of passive income and early retirement through index funds and real estate. Erin Lowry’s “Broke Millennial Takes On Investing” serves as a beacon for the younger generation, demystifying the complexities of investing and providing a roadmap for financial empowerment. Tailored to millennials, this book offers practical insights and actionable steps to navigate the world of investing with confidence.

Bonus Tip: Don’t just read, implement! Pair your book learning with practical application through online investing platforms or simulations.

Conclusion

Remember, investing is a lifelong journey, not a quick sprint. By choosing the right books and continuously learning, you’ll equip yourself with the knowledge and confidence to navigate the market and build a prosperous future.

Share your favorite investing books in the comments below! Let’s create a community of knowledge-hungry investors who navigate the market together.